Crew Van Tax: Is it treated as a car or a van?

https://businessvans.co.uk/van-tax/crew-van-tax-is-it-treated-as-a-car-or-a-van/ by Glynn Williams

Focus on benefit in kind taxation payable on crew vans:

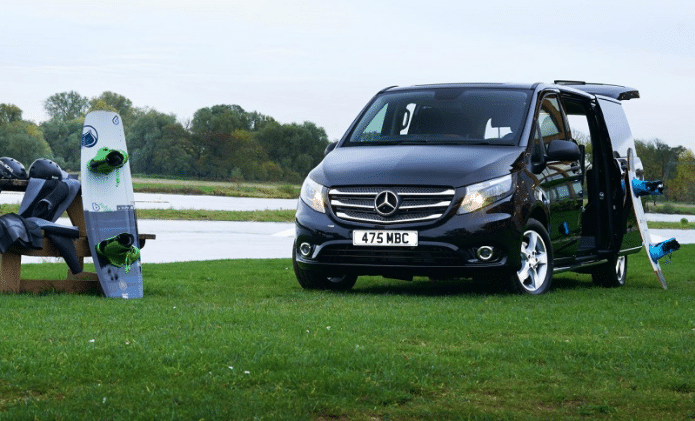

Confusion over-taxation of crew vans could equal an unwelcome tax bill

Look closely at the payload for any crew van you’re considering

Not all crew vans have a payload of over a tonne and adding extras can have an impact on this

Unwanted BIK bills a possibility if HMRC considers your crew van a car for taxation purposes

WHAT do you do if you want to combine business and pleasure when picking your next van? Well, what you’re looking for is a crew van with the attraction of low company van tax.

Why? So, you can either carry a team of workers or the family – and most crew vans offer load areas big enough to suit most purposes!

However, you should be aware of how HMRC may classify your crew van.

We have heard of some confusion when it comes to the taxation of these vans and whether they’re classed as cars or commercial vehicles for benefit in kind (BIK) tax – the same kind of conundrum that can arise with double cab pick-ups and their low tax attractions .

Unfortunately, it appears that HM Revenue’s car-derived van and combo list hasn’t been updated for a while – since 2015. So, there are important models missing from the list.

This makes it something of a grey area.

What’s the difference between a car and a van?

In the first instance, we’d always advise looking at the payload for any model that you’re considering. If it is over a tonne and the ‘primary use’ is carrying goods and not people, then it’s a CV as far as HMRC are concerned.

Official HMRC guidance defines a van as a vehicle of a construction primarily suited for the conveyance of goods or burden.

The guidelines state that:

the test is applied at construction

a vehicle designed and marketed as a multi-purpose vehicle is unlikely to be a van

a vehicle with side windows behind the driver and passenger doors is unlikely to be a van, particularly if fitted, or capable of being fitted, with additional seating behind the driver’s row irrespective of whether fitted in the vehicle at the time.

The crux of the issue is a matter of vehicle use rather than simply its construction.

A recent case highlighted that there are two sets of HMRC guidelines as set out for some years: one concerns the load-carrying capability of the vehicle as used and the other how it is used.

If it is solely used for business it is a van, but if the kombi has private use it becomes classified as a car for benefit in kind purposes. Check out HMRC’s guidelines.

The Business Van of the Year Crew Van, the VW T6 Kombi 2.0TDI T30 Highline SWB BMT 150PS model, makes an excellent van for carrying crew and cargo. Volkswagen Commercial Vehicles makes it clear on its website, saying the Kombi is ‘Perfect for cargo and crew‘. It also has a payload in excess of 1 tonne.

VW Transporter Kombi: check whether this is liable for company car tax if use goes beyond business only

Yet if this kombi van is classed as a car by HMRC it will have a P11D of £36,540, a company car tax band of 37% in 2018/19 for a BIK value of £13,120. This would result in an annual tax bill of £2,624, with fuel benefit tax adding £1,732 giving an monthly tax liability of £363 for a 20% taxpayer.

However even if it is classified as a car for BIK purposes, check it out on our company car tax calculator, it is still a van when it comes to road tax with first year VED of £250.

Be aware though, that not all crew vans have a payload of over a tonne, and adding extras can have an impact on this.

However, another point to be aware of is that the HMRC does not always simply apply the load metric to CV taxation and, over the years, several manufacturers have reported occasionally seeing inconsistencies in their approach and treatment of the van class.

Our advice would be to check with the van dealer as to the weight of the vehicle, once any optional extras are fitted, then check with your local tax office. If you don’t, you could end up with unexpected VAT issues, not to mention unexpected benefit in kind taxation.

Remember it is down to you, the individual, to check your own personal tax situation, with regards to a Crew Van. Because it might look like a van, be used as a van, yet HMRC may disagree with your interpretation of a van.